By Mark Stansfield

CoStar Analytics

6 February 2023 | 7:00

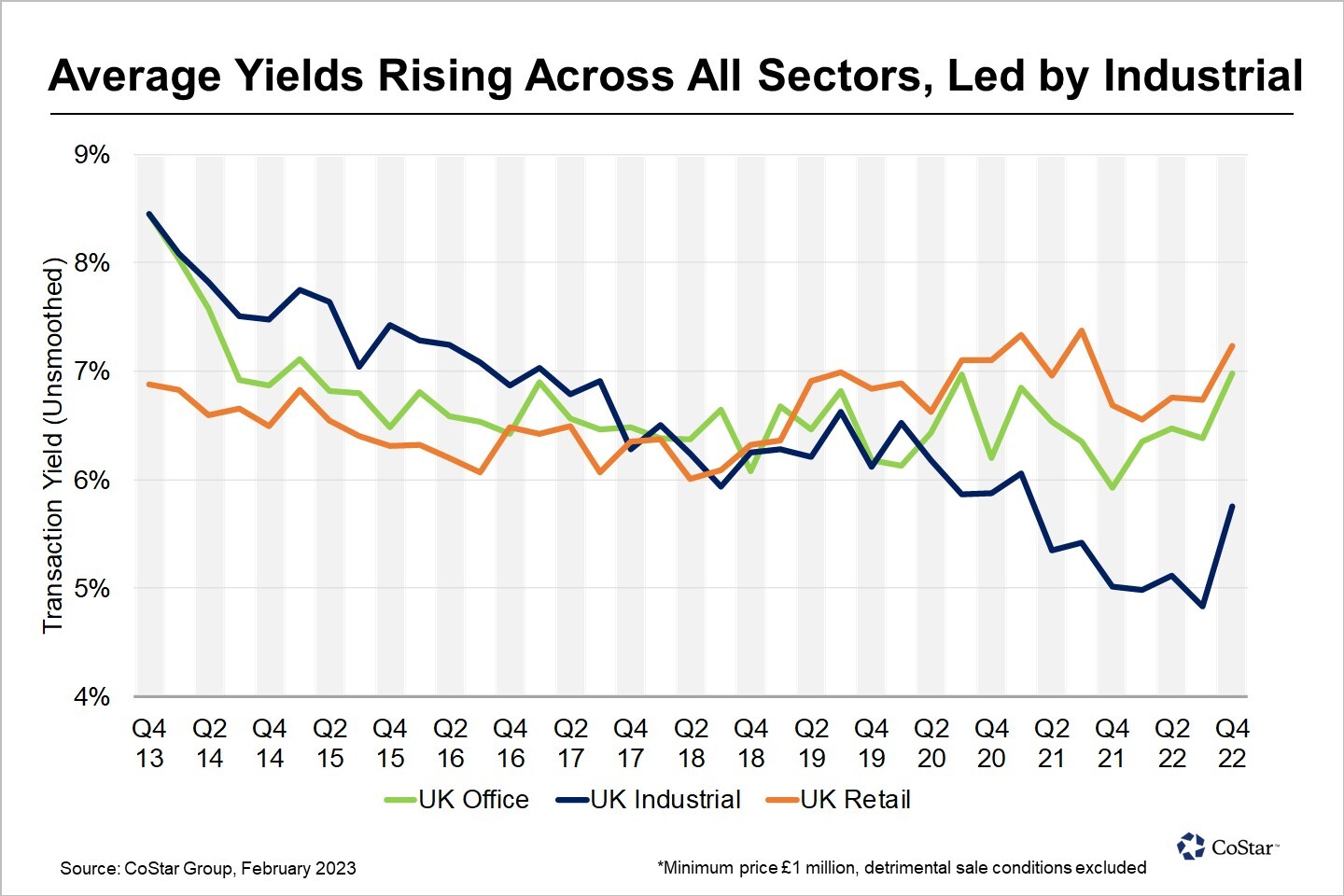

Rising interest rates and cooling investor demand have led to a significant increase in transaction-based yields in recent months, according to CoStar data.

The average yield rose across all three main commercial property types in the final quarter of 2022, based on yield observations on deals of £1 million or more.

The sharpest outward yield movement was recorded in the industrial sector, the lowest-yielding property type, where average yields rose by 90 basis points quarter-on-quarter to 5.8%. Average industrial yields are at their highest level in two years, with early indications suggesting they have moved out further in 2023.

Sub-4% yields, so prevalent in the industrial sector in recent years, have fallen away markedly as the cost of debt has risen, though they have not disappeared completely. A Yodel distribution facility in Hatfield was acquired for £49 million in November, a 3.6% yield, while Abrdn sold a warehouse on Fairview Industrial Park in Rainham in east London for £21.7 million, a 2.8% yield, a month earlier.

At the other end of the spectrum, a warehouse on Park Farm Road in Scunthorpe was sold by Columbia Threadneedle for £4 million, a 10.7% yield, in November.

Average yields in the office sector rose by 60 basis points to 7%, their joint-highest level since 2014. Weak trading in London was part of the story. Office investment sank to a 20-year low in the capital last quarter amid a stand-off between buyers and sellers as prices adjust to the new, higher interest rate environment. Early indications suggest yields are beginning to stabilise in a busier opening to 2023, however.

In the retail sector, which until 2017 was the lowest-yielding sector but in recent years has been the highest-yielding of the three main property types, average yields jumped by 50 basis points to 7.2%. This is the highest level since the third quarter of 2021, based on observed transactions.

Several shopping centres traded at yields of more than 10% last quarter. Torbay Council bought Union Square Shopping Centre in Torbay for £3.6 million, a 17.9% yield, while Golden Square Shopping Centre in Warrington changed hands for £22.5 million, a 12.2% yield. Both took place in December.

Property, which has benefited from a low interest rate environment and a healthy premium over government bond yields for more than a decade, has looked less attractive in relative terms in recent months. The rising cost of debt has also meant fewer buyers, and more deals looking less viable at early 2022 pricing.

With property yields potentially rising further in the coming months, income growth is likely to be the sole driver of returns. In this context, investors are likely to pivot further towards subsectors with the strongest rent growth potential and those most resilient to inflation, although higher-yielding retail properties and redevelopment or refurbishment opportunities could become more appealing, too, especially in an increasingly polarised office sector.

Rapid repricing in the UK, unlike in many other European countries, is likely to draw in more buyers as the year unfolds. This should boost transactional activity in the second half of the year and could help to stabilise yields. The more dovish tone emanating from the Bank of England on Thursday should offer some reassurance over the path of interest rates, too. The Bank increased interest rates by another 50 basis points on Thursday, to a 15-year high 4%, but they appear close to their ceiling in this cycle.