Savills Predicts Investment Will Start Slowly and End Strongly This Year in a Reversal of 2022 But Says Around £54 Billion Will Trade Again

The fall in UK commercial property prices is nearing its end game but the bottom has not quite been reached, according to Savills.

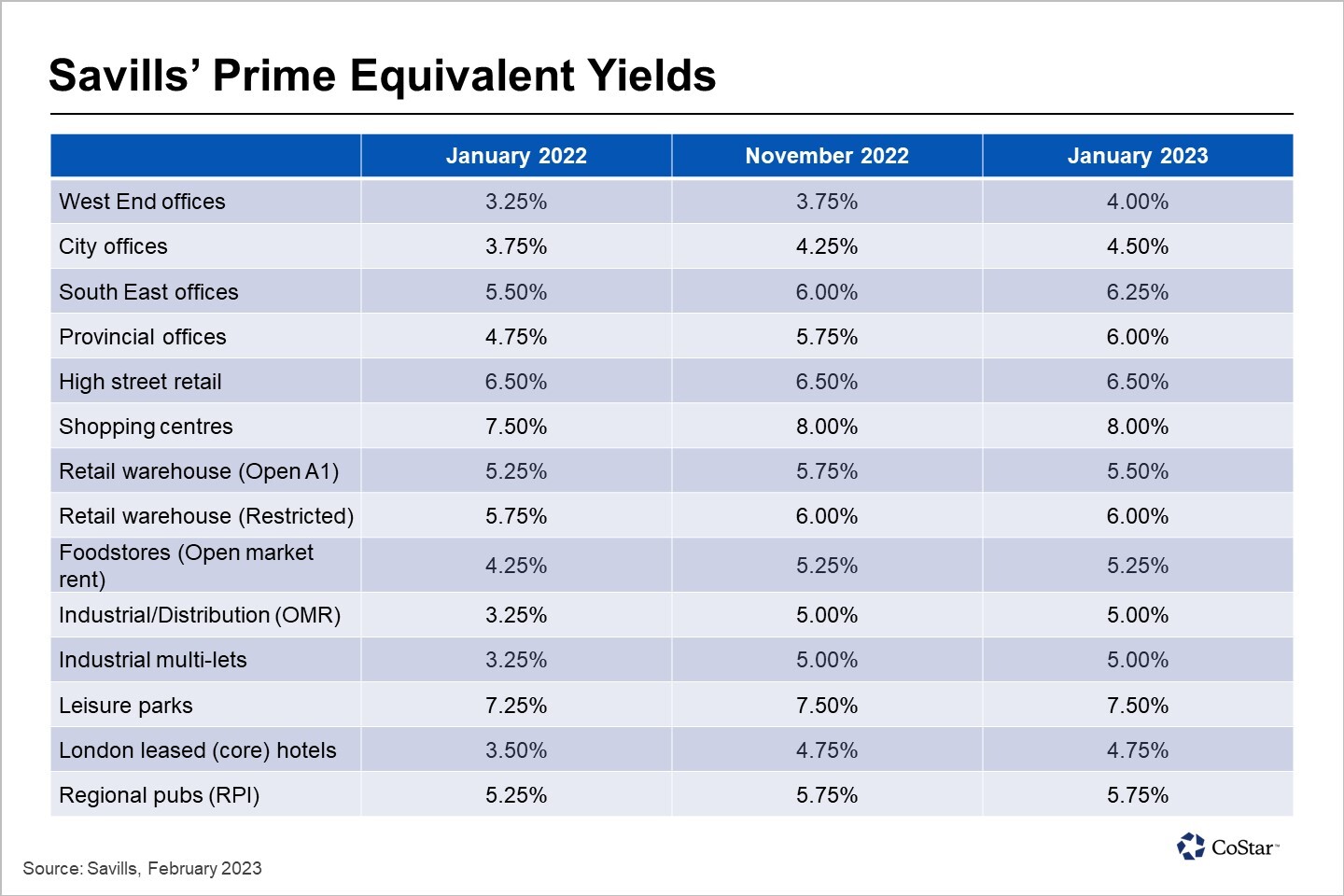

Its latest UK Commercial Market in Minutes report quantifies average yield movements across sectors.

Savills says January’s yields are a very mixed story, with downwards pressure on parts of retail, stability in logistics and softening in prime office yields. The average prime yield softened to 5.68%, its highest level since 2008. It also means average prime yields have moved out 77 basis points since January last year.

The adviser points out that January is always characterised by a lack of transactional evidence, and it expects this to continue through the first quarter of the year.

Savills is predicting transactional volumes in 2023 will be a reversal of 2022’s strong start and weak finish, but that volumes are likely to be similar at around £54 billion.

It says the month’s most interesting bellwether for the future is the stabilisation in prime logistics yields, which it suggests is the first sign that the pricing plateau might have been reached in some sectors.

Savills writes: “While the short-term occupational outlook for logistics will be affected by a weak consumer economy, the sector came into this growth shock with near record low vacancy rates, and we expect this state to reassert itself through 2024 and beyond. This will increase upward pressure on rents for the best space in the best locations.”

In offices, shortages of “prime” and “green” will bring stronger rental growth for better quality space.

Savills’ biggest concern remains the impact of higher base rates on both households and businesses, after successive interest rate rises.

It says for the higher cost of borrowing will impact on house prices and rents this year in the domestic sector, while in the corporate sector, it thinks the SME sector has taken on higher debt levels in the post-COVID period, and refinancing or repaying this debt will present a problem for some in 2023 and 2024.

Savills says the tail of this interest shock will negatively impact on some parts of the occupational markets, and generally, it is forecasting rises in vacancy rates across all of the main commercial property sectors this year.

Savills says a positive of the higher cost of borrowing is that development finance will become scarcer and more expensive and this will lead to 50–60% reduction in development starts this year, and a similar reduction in completions in two to three years’ time.

It predicts this will exacerbate shortages of supply that were present in prime office and logistics markets, just at a time when corporate occupiers are demanding better and greener premises. As such it is revising rental growth forecasts upwards and this means that the plateau in pricing may come sooner than some expect.

Savills says the debate around offices and agile working is undeniably having an impact on take-up but says some investors seem “stuck in a mindset that a seismic shock akin to the rise of internet retailing on shops is underway”.

It points out that office take-up in the large regional cities last year was 8% down on the five-year average, but still up year on year. In central London, office take-up was 13% up on 2021 and exactly in line with the 10-year average.

Savills explains: “There is no doubt that numbers are being flattered by a short-term surge in companies choosing to upgrade the environmental rating of their building sooner than they might have normally moved, and this is coming through in a higher propensity to move on both break and lease expiry.

“However, what is also apparent is that despite agile working, there is still a strong demand for good quality office space across the UK. The challenge for tenants will be the lack of supply.”