Russia’s invasion of Ukraine marked ‘new era for real estate’

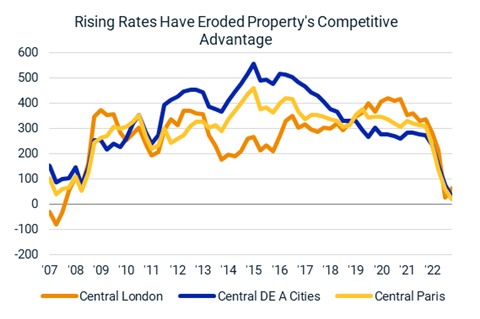

Russia’s invasion of Ukraine signalled a new era for commercial real estate, as the end of the low interest rate environment means investors no longer treat commercial real estate as a bond proxy, according to MSCI. Chart shows basis-point spread and office yields to 10-year government bonds Source: RCA Hedonic Series office yields MSCI’s report, Global Markets One Year After Russia’s Invasion of Ukraine, noted that the Ukraine war coincided with the end of the post-2008 global financial crisis boom brought about by the low-rate, low-return environment that pushed trillions of dollars into global real estate, depressing yields and driving prices up to record levels. “Russia’s invasion now appears to have signalled the end of that expansion and the start of a transition to a new world of higher rates and higher returns,” explained Tom Leahy, MSCI’s head of EMEA real assets research. According to Leahy, the rapid rise in swap rates meant debt costs surged above property [...]