Carter Jonas Says Land Values Are Still Nearly 24% Ahead of Where They Were Three Years Ago

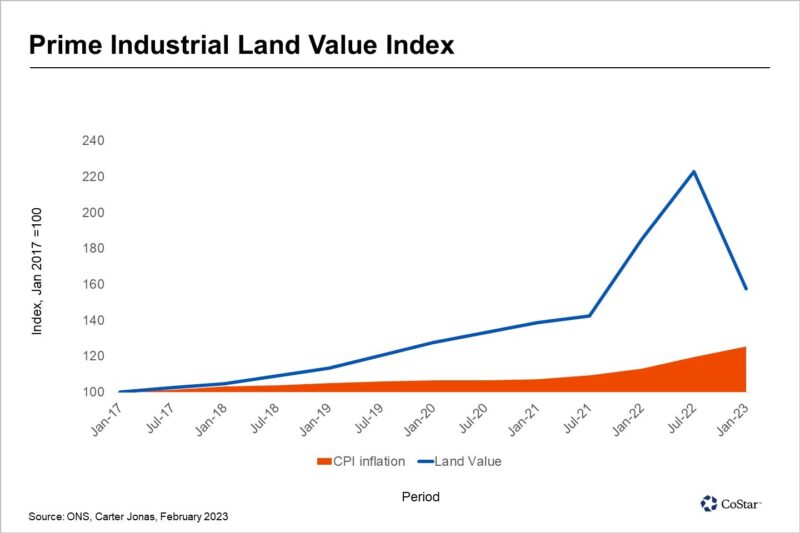

Industrial land values have fallen 29.3% on average across the UK since mid-2022 but the decline has stabilised, according to the Carter Jonas Industrial Index.

Carter Jonas explains that as developers have retreated recently, the development land market has struggled, which has precipitated a readjustment in industrial land values over the last few months, and that has only been accentuated by the recent rise in industrial yields.

Its figures are presented as an index based on land value data from transactions it has tracked.

But Dan Francis, head of research, Carter Jonas, pointed out that while the fall sounds significant, it is not as large a correction as some have anticipated. “It should be remembered that values are still nearly 24% higher than their level three years ago.”

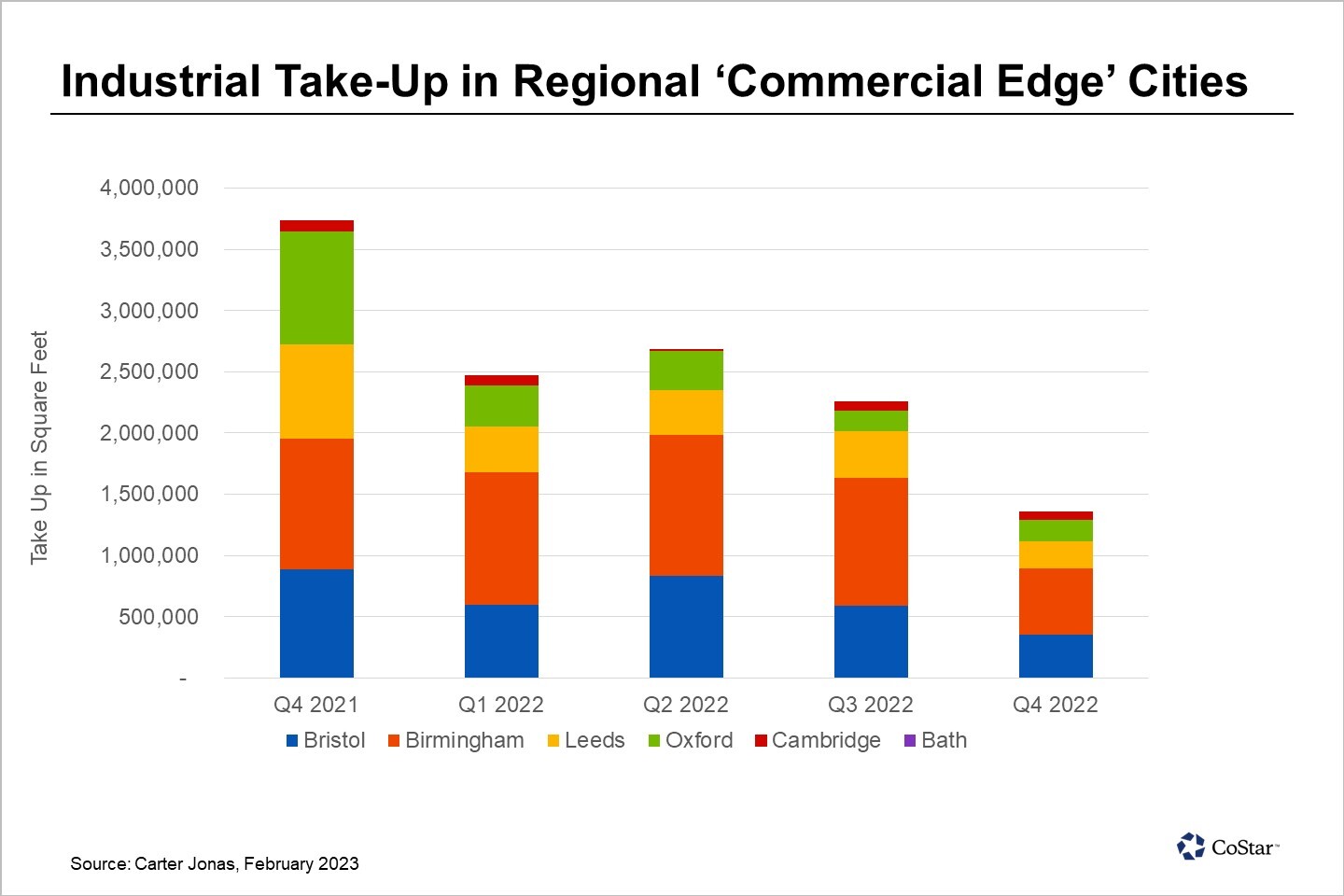

Take-up in the UK industrial market reduced in 2022 compared with 2021, with activity in the last quarter of the year proving particularly quiet, reports Carter Jonas.

Across the firm’s “Commercial Edge” research locations (including Birmingham, Bristol, Cambridge, Leeds and Oxford), just under 1.4 million square feet let in the final quarter, down 40% quarter on quarter and 64% down year on year.

Carter Jonas said the fall was largely due to the absence of quality available stock, rather than particularly weak underlying demand, as strong competition amongst occupiers for existing and new build product has kept rents up despite deteriorating economic conditions.

Following robust growth in prime headline rents of 22% in 2021, 2022 was a year of two halves, Carter Jonas added. Above-inflation growth of 9% was recorded during the first half of the year, but prime rental levels have been broadly static since the end of Q2 2022.

Andy Smith, partner, commercial, Carter Jonas, said in a statement: “Supply constraints will exert some upward pressure on rents this year, although we expect growth to be below inflation. However, the mere fact that we don’t see rents falling, given the challenging economic outlook, illustrates the resilience of the industrial sector.”

The national adviser said developers have been challenged by sharply rising build costs and supply chain problems, together with the rising cost of debt, and broader economic uncertainty. These factors continue to hold back development activity, and with ongoing healthy occupier demand, the market for prime space will remain tight throughout 2023, Carter Jonas predicts.

Smith added: “The recent low level of development activity means that developers starting on site this year should face only limited competition and be in a strong position to capitalise on the benign outlook for occupier demand.”

Smith concluded: “The market for prime sites is holding up well, and we are now seeing signs of a recovery in land values, with some sites within the M25 recently showing an increased bidding tension. There are still buyers with plenty of cash in the system for industrial property and land.”