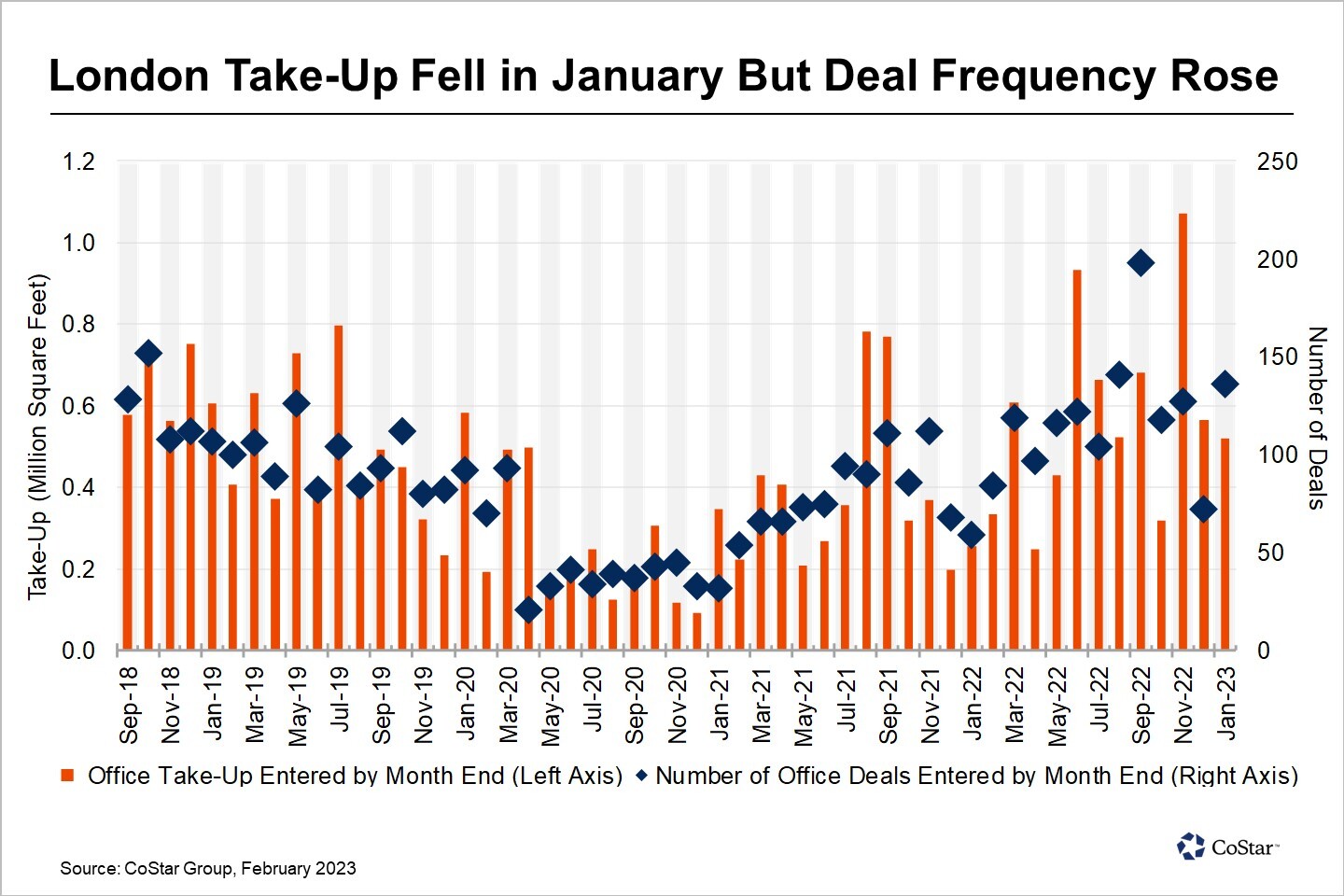

London Office Take-Up Fell in January but Deal Frequency Climbed to a Four-Month High

By Mark Stansfield CoStar Analytics 8 February 2023 | 14:19 London’s office occupier market remained busy in January as occupiers pressed ahead with space upgrades despite growing fears of recession, according to CoStar data. January was the most active month since September and the third-busiest month in the past five years in terms of the number of lettings, based on deals collected by month-end. This measure is used in the analysis to allow for like-for-like comparisons as CoStar researchers continue to collect deals that have occurred in recent weeks. This follows a quiet December, when deal activity slumped to an 11-month low, although the higher proportion of smaller deals meant overall take-up in January was down 8% month-on-month and 51% below a bumper November, when big prelets by law firms Clifford Chance and Reed Smith pushed monthly take-up to a five-year high. Encouragingly, the largest deal last month was an expansion, unlike the Clifford Chance and Reed Smith deals, [...]