By Lisa Dean

CoStar Analytics

31 January 2023 | 12:03

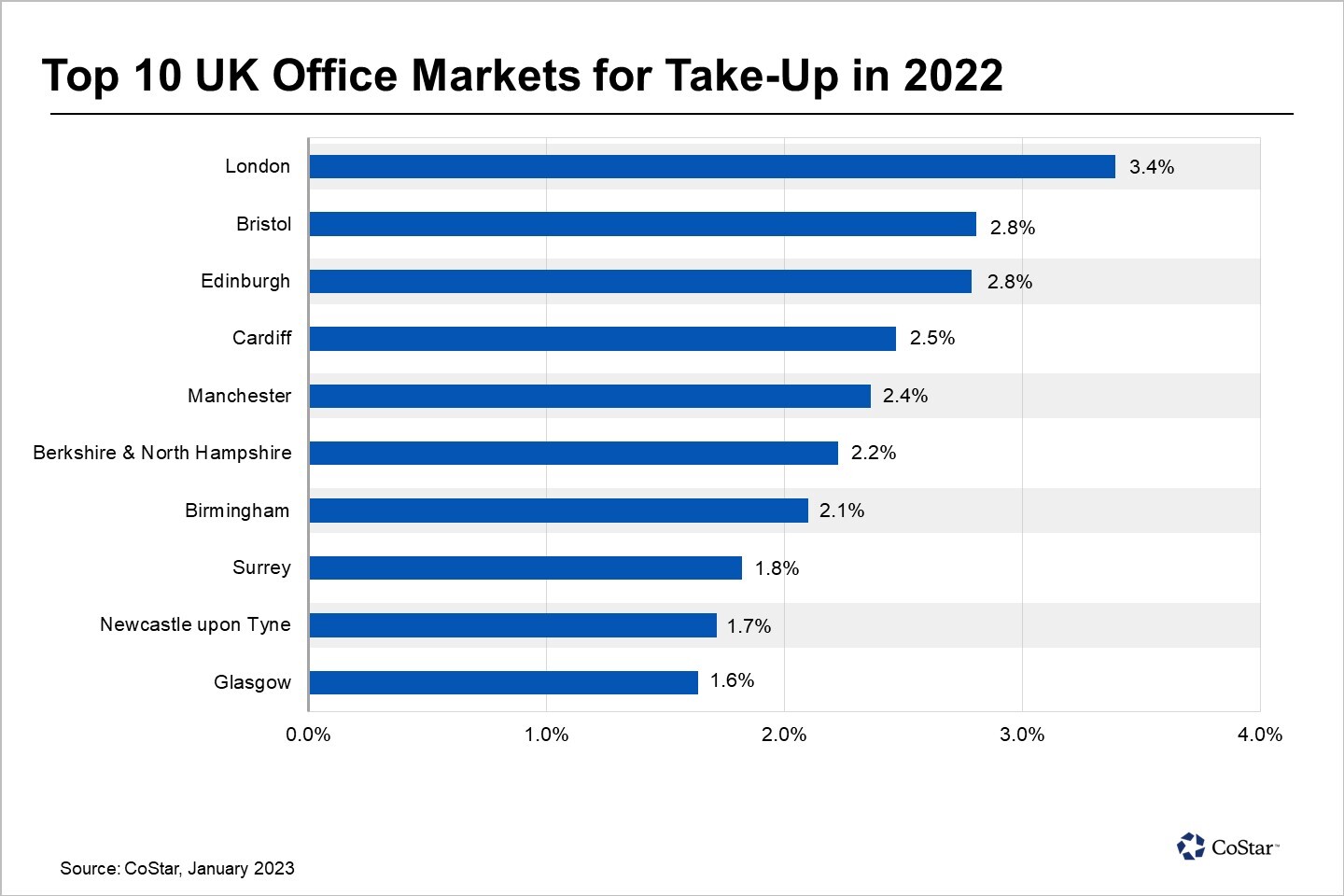

London topped the table for take-up as a percentage of stock among major office markets in 2022, closely followed by Bristol and Edinburgh.

Finance, legal and technology sectors are seeking top quality space as employees returned to offices. In London, around a third of lettings occurred in 5 Star buildings last year, a record high. In the Big Six regional cities of Birmingham, Bristol, Edinburgh, Glasgow, Leeds and Manchester, 4 and 5 Star-rated offices accounted for over 40% of take-up for a third straight year.

Finance and law firms drove activity at the larger end in London, where take-up was equivalent to 3.4% of stock. Blackstone expanded its footprint by pre-leasing 225,000 square feet at Berkeley Square in the third quarter, while other financial firms were largely cutting their footprints. Law firm Clifford Chance later pre-let 328,000 square feet at 2 Aldermanbury Square, though it is downsizing from 700,000 square feet in Docklands.

Bristol also outperformed, with 2.8% of its office stock leased in 2022, thanks to robust demand from tech firms. Fintech firm Paymentsense’s pre-let of 55,000 square feet at EQ in February was one of the standout deals of the year. Pax8 later took space at the newly built No 2 The Distillery in June, while Techmodal acquired 11,000 square feet at the newly refurbished Pivot + Mark in the same month. Epic Systems followed, taking a total of 30,000 square feet at Hartwell House in December and The Core in March.

Edinburgh fared similarly well for leasing as a share of stock last year at 2.8%. Notably BlackRock doubled its footprint in the Scottish capital by leasing 140,000 square feet at Dundas House, reversing the trend of financial firms offloading space. Leasing volumes were supported by ongoing tenant demand for newer and greener offices like 9 Haymarket Square and Capital Square, as well as tech firms seeking smaller spaces.

The tech sector was also behind strong leasing in the smaller markets of Cardiff and Reading. BT and Roku were among the most active in in the Welsh capital. Downsizing and expansion were the themes among tech firms in Reading, where Huawei scaled back its UK office space, downsizing by more than 100,000 square feet. Cybersecurity company Rapid7, on the other hand, leased an extra 14,000 square feet by relocating to 2 Forbury Place in the city centre.

Despite recent leasing momentum, vacancy is rising across the UK as new projects deliver and occupiers downsize. These trends are expected to continue in the year ahead.