By Mark Stansfield

CoStar Analytics

8 February 2023 | 14:19

London’s office occupier market remained busy in January as occupiers pressed ahead with space upgrades despite growing fears of recession, according to CoStar data.

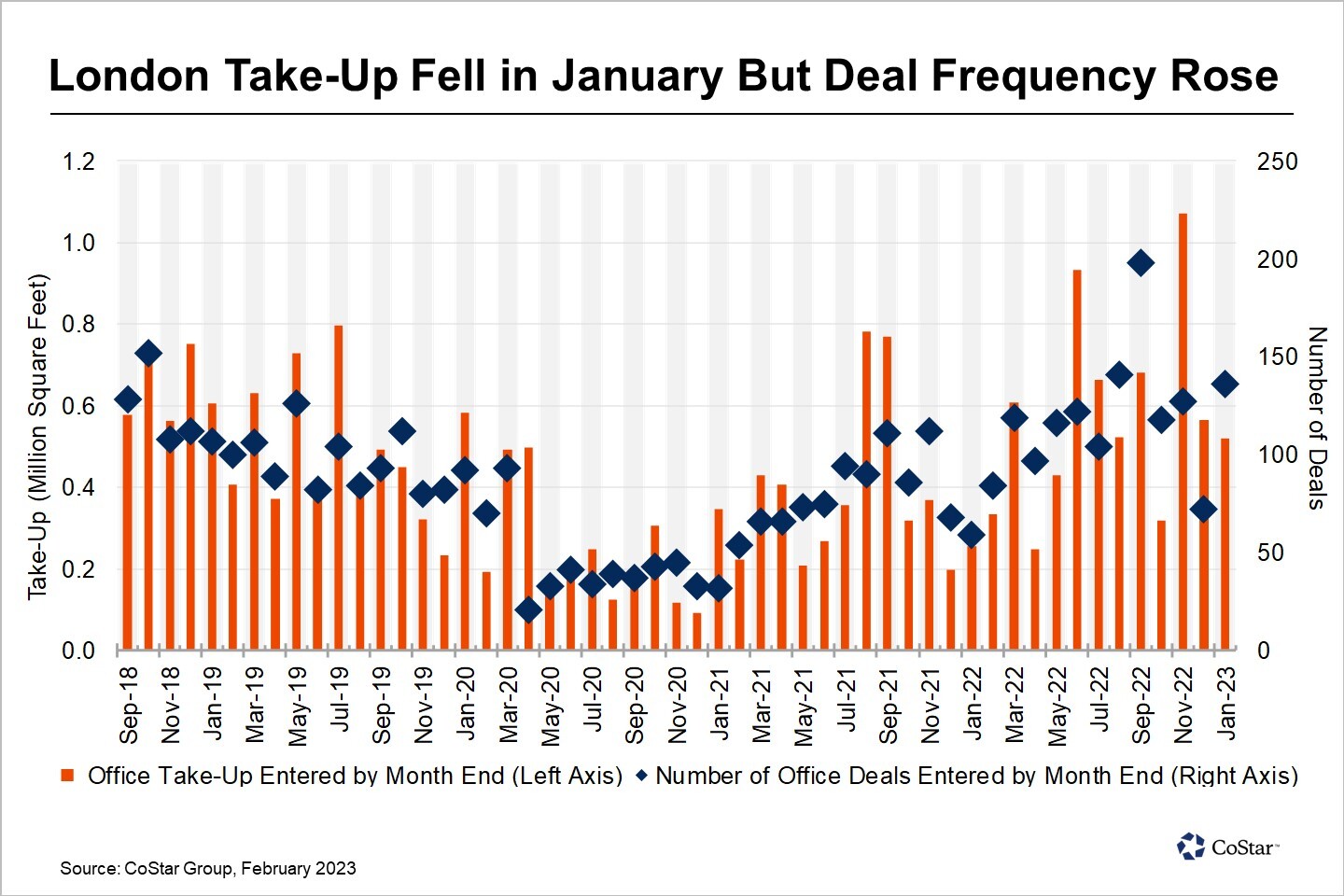

January was the most active month since September and the third-busiest month in the past five years in terms of the number of lettings, based on deals collected by month-end. This measure is used in the analysis to allow for like-for-like comparisons as CoStar researchers continue to collect deals that have occurred in recent weeks.

This follows a quiet December, when deal activity slumped to an 11-month low, although the higher proportion of smaller deals meant overall take-up in January was down 8% month-on-month and 51% below a bumper November, when big prelets by law firms Clifford Chance and Reed Smith pushed monthly take-up to a five-year high.

Encouragingly, the largest deal last month was an expansion, unlike the Clifford Chance and Reed Smith deals, which were net space reductions. Chinese social media phenomenon TikTok leased 139,000 square feet at the Verdant scheme on Aldersgate Street in yet another noteworthy deal within close proximity to Farringdon Station, where Elizabeth line services opened last year.

Other deals of note included insurance firm Direct Line taking 48,000 square feet at Riverbank House in the City and Dutch co-working firm InfinitSpace continuing its expansion by taking 24,000 square feet at Kingsbourne House in Holborn. Both these buildings are also within striking distance of Farringdon Station.

In the West End, Grosvenor secured its first prelet at its 65 Davies Street scheme near Bond Street Station, with asset manager Hayfin taking 23,000 square feet across the fourth and fifth floors. Further west, January was also notable for Ashby Capital’s first letting at the Kensington Building, where French multinational EssilorLuxottica took 23,000 square feet.

While deal activity rose in January, the overall picture remains relatively gloomy. Building society Nationwide joined a host of firms looking to offload space earlier this week, with the likes of Barclays and Facebook also putting large offices on the market for sublease. Gerald Eve recently reported that the amount of grey space on the market was at a record high.

There is also the supply side. Should all projects complete on time, 2023 will be London’s busiest year for net deliveries in 20 years. London’s vacancy rate is likely to climb further as these buildings complete construction in an environment of subdued demand, though the capital’s newest, most sustainable buildings should continue to fare well amid an ongoing flight to quality.