Russia’s invasion of Ukraine signalled a new era for commercial real estate, as the end of the low interest rate environment means investors no longer treat commercial real estate as a bond proxy, according to MSCI.

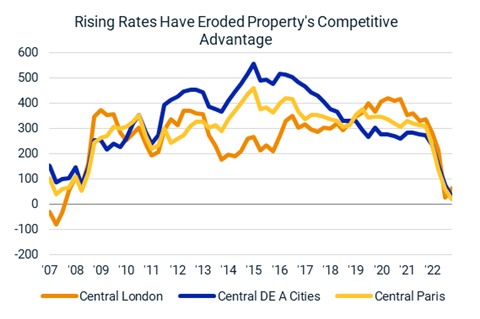

Chart shows basis-point spread and office yields to 10-year government bonds Source: RCA Hedonic Series office yields

MSCI’s report, Global Markets One Year After Russia’s Invasion of Ukraine, noted that the Ukraine war coincided with the end of the post-2008 global financial crisis boom brought about by the low-rate, low-return environment that pushed trillions of dollars into global real estate, depressing yields and driving prices up to record levels.

“Russia’s invasion now appears to have signalled the end of that expansion and the start of a transition to a new world of higher rates and higher returns,” explained Tom Leahy, MSCI’s head of EMEA real assets research.

According to Leahy, the rapid rise in swap rates meant debt costs surged above property yields after years when a substantial gap had encouraged capital into the sector.

Meanwhile, the impact of rising interest rates was most acutely felt in Europe. Leahy highlighted that this was particularly the case in Germany, fuelled by the country’s reliance on Russian energy.

Consequently, German property sales started to slow in April, sank to a six-year low for the first half of the year and continued to fade through the rest of 2022.

Global transaction volumes were down 64% in Q4, and Leahy explained that very few countries escaped the slowdown, as buyer and seller price expectations moved apart, leading to a substantial drop in liquidity.

“In the short term, further easing in inflation, plus stability in bond yields and debt costs, would provide a degree of security and give buyers and sellers more solid ground on which to make their buy-sell-hold decisions,” said Leahy.

He added: “Once past this shorter-term disruption, the question is where real estate fits into a remodelled investment landscape. Core property effectively acted as a bond substitute during the low-rate regime, but interest rates and bond yields will likely settle at a higher level than during the last cycle. This means property may serve a different purpose in a multi-asset-class context.”