By Mark Stansfield

CoStar Analytics

16 January 2023 | 09:00

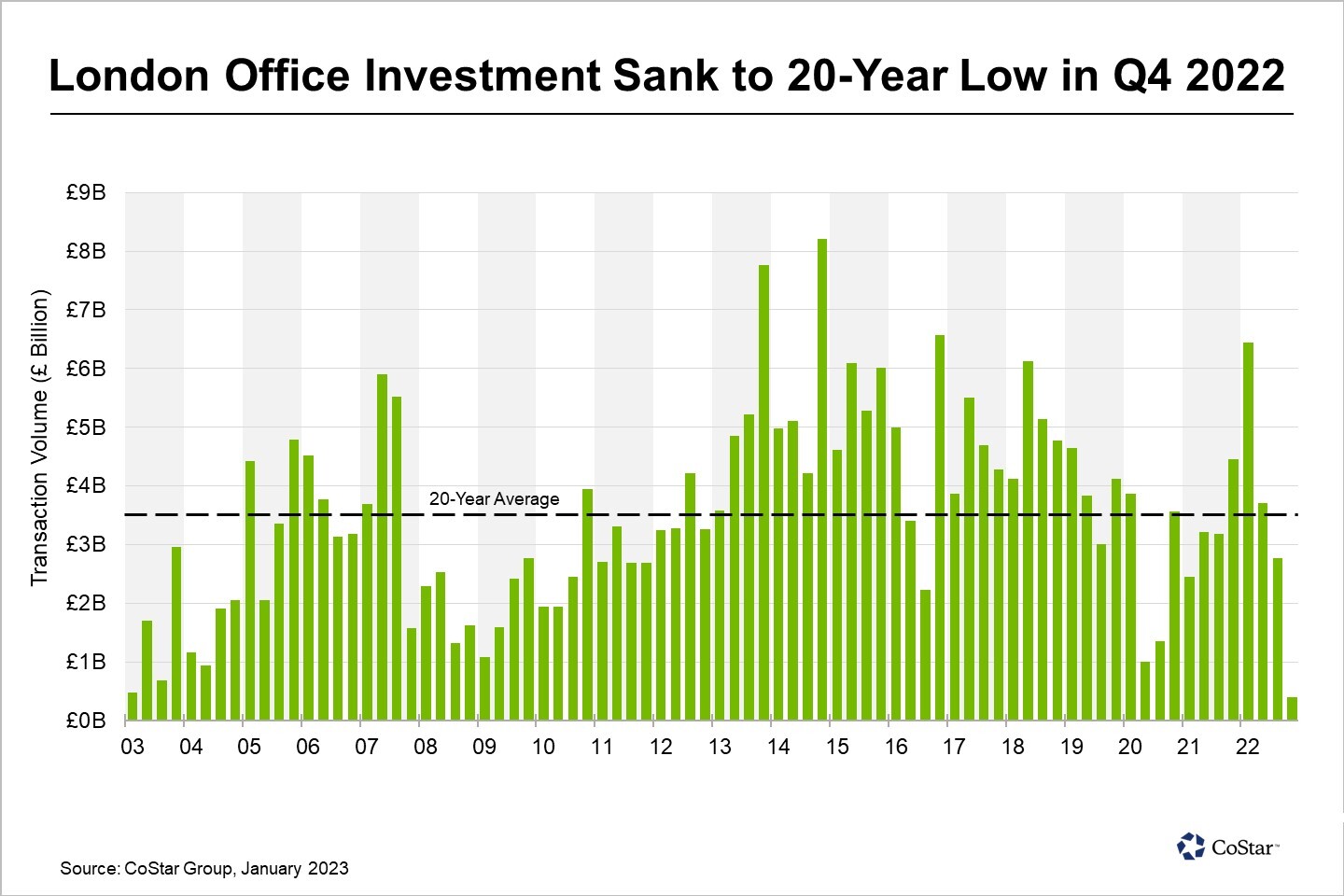

London office investment slumped in the final months of 2022 as rising interest rates and uncertainty over pricing brought the market to a virtual standstill, according to CoStar data.

Less than £500 million of London offices changed hands in the fourth quarter, a drop of more than 80% on the £2.8 billion spent in the third quarter and more than 90% down on the £6.4 billion transacted in the first quarter of 2022, when hopes for a strong post-pandemic recovery unleashed a wave of blockbuster deals.

The figures make the fourth quarter the weakest quarter in more than 20 years. Volumes were less than half those recorded in the lockdown-hit second quarter of 2020 and comfortably below the levels in the depths of the financial crisis at the start of 2009. Annual volumes remained on par with those in 2021 with just over £13 billion changing hands thanks to a bumper start to the year.

Only a handful of transactions over £10 million took place last quarter. By far the biggest deal occurred in November, when Singapore’s Hoi Hup Realty bought Holborn Gate in Midtown for £160 million. The 159,000-square-feet building previously traded for £138 million in 2016, shortly after it was refurbished. It was a strategic long-term acquisition for Hoi Hup, as its ownership of several neighbouring buildings unlocks a major development site.

Among few other deals of note included two in the West End, with Criterion Capital acquiring 89 Eccleston Square for around £40 million in a potential repositioning play – having been initially marketed by M&G at £57.5 million in February and a sale agreed at this level – and Singapore’s The Land Managers buying 6-10 Cavendish Place for £18.6 million at 11% below the asking price. In the City, 85 London Wall sold for £35 million.

Weak fourth-quarter trading reflected cooling investor demand amid rising interest rates, which reduce the relative attractiveness of property and raise borrowing costs, as well as political uncertainty following the calamitous mini Budget in late September and the growing likelihood of recession.

However, it also reflects a lack of distress in the market, with building owners that do not need to sell holding fire until more clarity emerges around the economic outlook, the path of interest rates and how far property prices have fallen. This clarity should start to unlock trading again as 2023 unfolds, with several large deals in London already on the cusp of closing in January. The second half of the year is likely to be busier than the first.